Ukrainian media outlet ZN.UA reported on May 10 that their law enforcement sources confirmed an ongoing probe by the National Anti-Corruption Bureau into suspected embezzlement, money laundering and bribery.

Iran is preparing to send Russia Fath-360 short-range ballistic missile launchers, Reuters reported on May 9, citing Western security and regional officials familiar with the matter.

"Ukraine and all allies are ready for a complete unconditional ceasefire on land, in the air, and at sea for at least 30 days, starting as early as Monday," Ukraine's Foreign Minister Andrii Sybiha wrote.

U.S. President Donald Trump has acknowledged in private that Russia is difficult to negotiate with because they "want the whole thing," referring to Ukraine, the WSJ reported, citing sources familiar with the comments.

The visit marks Merz’s first trip to Ukraine, and the first time all four leaders have travelled there together.

A notice about the airspace closure was published on the U.S. Defense Department's NOTAM (Notice to Airmen) website on May 10, as cited by Ukrainian defense news outlet Militarnyi.

"As in the past, it is now for Russia to show its willingness to achieve peace," the EU's statement reads.

Kremlin spokesperson Dmitry Peskov rejected the idea of a 30-day ceasefire between Russia and Ukraine, claiming in an interview with ABC News on May 10 that it would be "an advantage" for Ukraine.

"Our involvement in the war was justifiable, and this belongs to our sovereign rights," North Korean dictator Kim Jong Un said. "I regard this as part of the sacred mission we must execute for our brothers and comrades-in-arms."

The number includes 1,310 casualties that Russian forces suffered over the past day.

"We have a plan B and a plan C. But our focus is plan A, the essence of which is to get everyone's support" for Ukraine's accession, EU foreign policy chief Kaja Kallas said.

"(T)he presence at the Victory Parade of a country that bombs cities, hospitals, and daycares, and which has caused the deaths and injuries of over a million people over three years, is a shame," Polish Prime Minister Donald Tusk said.

"According to the participants of the performances, their goal is to remind the civilized world of the barbaric actions of Moscow, which for many years and decades has systematically violated international law," a source in Ukraine’s military intelligence agency (HUR) told the Kyiv Independent.

Russia keeps key interest rate at 21%, defying expert expectations

Russia's Central Bank decided on Dec. 20 to keep its benchmark interest rate steady at 21%, contrary to expert expectations of an increase, Russia’s state-owned TASS news agency reported.

To rein in accelerating inflation fueled by war spending, Russia's Central Bank has been raising its interest rate from 7.5% in July 2023 to the current 21% - the highest level since the early 2000s.

The tight monetary policy of Elvira Nabiullina, the Central Bank's chief, has drawn criticism from businesses in Russia's military-industrial complex. On Dec. 19, Russian President Vladimir Putin also mentioned the problem, saying that some experts believe that the central bank should have started using tools other than rate hikes to fight inflation.

Most analysts, including those polled by Russian media outlet RBC, anticipated a hike of 200 basis points to 23%.

Ahead of the decision, major Russian banks raised savings deposit yields to 24-25% per annum, reflecting expectations of tighter monetary policy.

The Central Bank said that, based on inflation and credit trends, the feasibility of raising the rate further would be assessed at its next meeting.

Nabiullina has been involved in a conflict over rate hikes with Sergei Chemezov, the influential CEO of the state-owned defense giant Rostec.

"If we continue working this way, most enterprises will essentially go bankrupt," Chemezov said in October, commenting on increases in the Central Bank's rate.

Former economic advisor and opposition politician Vladimir Milov told the Kyiv Independent in November that both sides have valid concerns.

"Chemezov is right that businesses will have to shut down at such a (high interest) rate," he told the Kyiv Independent, "Nabiullina is right that the rate cannot be cut because in that case there will be hyperinflation like in Turkey."

He continued that "there is only one way out — finish the war and withdraw Russian troops" from Ukraine.

The balance between controlling inflation and maintaining economic stability remains a critical challenge for Russia’s Central Bank, as the war economy continues to strain the nation's financial system.

Most Popular

After 3 years of full-scale war in Ukraine, Europe announces plan to ban all Russian gas imports

Ukraine, Europe's ceasefire proposal includes US security guarantees, no recognition of Crimea, Reuters reports

Journalist Roshchyna's body missing organs after Russian captivity, investigation says

After Russia's deadly attack on Kyiv, Vance reposts denunciation of Zelensky

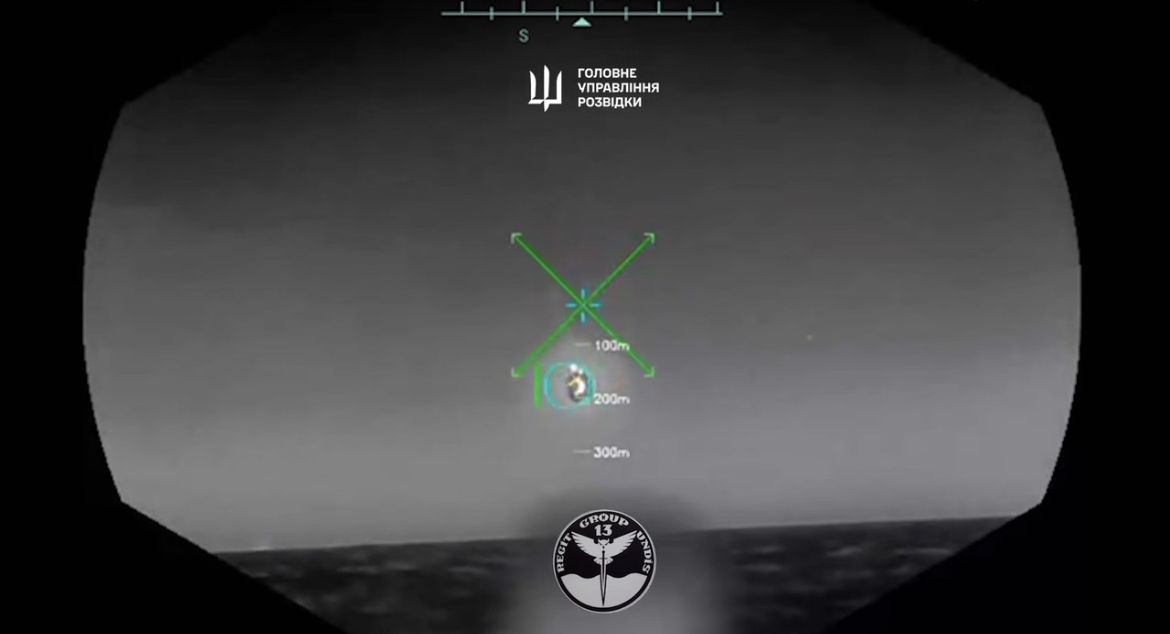

Ukrainian sea drone downs Russian fighter jet in 'world-first' strike, intelligence says

Editors' Picks

How medics of Ukraine’s 3rd Assault Brigade deal with horrors of drone warfare

As Russia trains abducted children for war, Ukraine fights uphill battle to bring them home

'I just hate the Russians' — Kyiv district recovers from drone strike as ceasefire remains elusive