"(T)he presence at the Victory Parade of a country that bombs cities, hospitals, and daycares, and which has caused the deaths and injuries of over a million people over three years, is a shame," Polish Prime Minister Donald Tusk said.

"According to the participants of the performances, their goal is to remind the civilized world of the barbaric actions of Moscow, which for many years and decades has systematically violated international law," a source in Ukraine’s military intelligence agency (HUR) told the Kyiv Independent.

"I have great hope that an agreement for a ceasefire in Ukraine will be reached this weekend," German Chancellor Friedrich Merz said on May 9, shortly before traveling to Kyiv alongside the leaders of France, Poland, and the U.K.

U.K. Prime Minister Keir Starmer, French President Emmanuel Macron, German Chancellor Friedrich Merz, and Polish Prime Minister Donald Tusk will arrive in Kyiv early on May 10.

The United States embassy in Kyiv on May 9 issued a warning that Russia could launch "a potentially significant" attack in the coming days, despite Putin's self-declared Victory Day "truce."

The sanctioned oil tankers have transported over $24 billion in cargo since 2024, according to Downing Street. The U.K. has now sanctioned more shadow fleet vessels than any other country.

The sanctions list includes 58 individuals and 74 companies, with 67 Russian enterprises related to military technology.

Washington and its partners are considering additional sanctions if the parties do not observe a ceasefire, with political and technical negotiations between Europe and the U.S. intensifying since last week, Reuters' source said.

Despite the Kremlin's announcement of a May 8–11 truce, heavy fighting continued in multiple regions throughout the front line.

Putin has done in Russia everything that Luiz Inacio Lula da Silva had been against in Brazil.

EBRD co-launches $116 million guarantee for Ukraine war-risk insurance

The European Bank for Reconstruction and Development (EBRD) and the Aon risk management firm launched a 110-million-euro ($116 million) guarantee program to help insurers cover some war-related risks in Ukraine, the EBRD announced on Dec. 12.

Ukraine's insurance companies have struggled to offer war insurance services as international reinsurers have largely withdrawn from the market after the outbreak of Russia's full-scale war in 2022.

The EBRD's new Ukraine Recovery and Reconstruction Guarantee Facility will help reinsurance companies cover risks connected to land-based transport, focusing on small and medium businesses.

It currently does not extend to fixed assets or maritime transport, though the bank said in a press release that the program may evolve based on market demand.

In August, the Marsh McLennan risk management company launched a $50 million insurance facility for grain shipped via the Black Sea.

The EBRD's facility was launched with the support of European donors and in partnership with the Ukraine-based insurance companies INGO, Colonnade, and Uniqua, as well as the international reinsurer MS Amlin, enabling the companies to ensure higher amounts.

The program does not include a pre-determined list of companies that will be involved, meaning that it will respond to market demand. The EBRD said the facility should enable insurance coverage for over 1 billion euros ($1.05 billion) in vehicles and goods in transit annually.

Active in Ukraine throughout the full-scale war, the EBRD is an international investment institution that has invested more than $5.6 billion in Ukraine since February 2022.

Aon is a British-American professional services company founded by American billionaire Pat Ryan.

"The EBRD’s guarantee will enable private-sector reinsurers to re-engage on Ukrainian war risk and build a resilient insurance market in Ukraine," EBRD President Odile Renaud-Basso said in a statement.

"This is crucial to giving businesses confidence that their assets are protected, which, in turn, will unlock and accelerate investment in Ukraine."

The program was coordinated with Ukraine's Economy Ministry and the National Bank.

"We are sincerely grateful to the EBRD and all parties involved in launching this insurance mechanism. The market has been eagerly anticipating it," Economy Minister Yuliia Svyrydenko said.

"I am confident that this mechanism will provide much-needed support for small and

medium-sized businesses, which have been severely affected by the war."

Most Popular

After 3 years of full-scale war in Ukraine, Europe announces plan to ban all Russian gas imports

Ukraine, Europe's ceasefire proposal includes US security guarantees, no recognition of Crimea, Reuters reports

Journalist Roshchyna's body missing organs after Russian captivity, investigation says

After Russia's deadly attack on Kyiv, Vance reposts denunciation of Zelensky

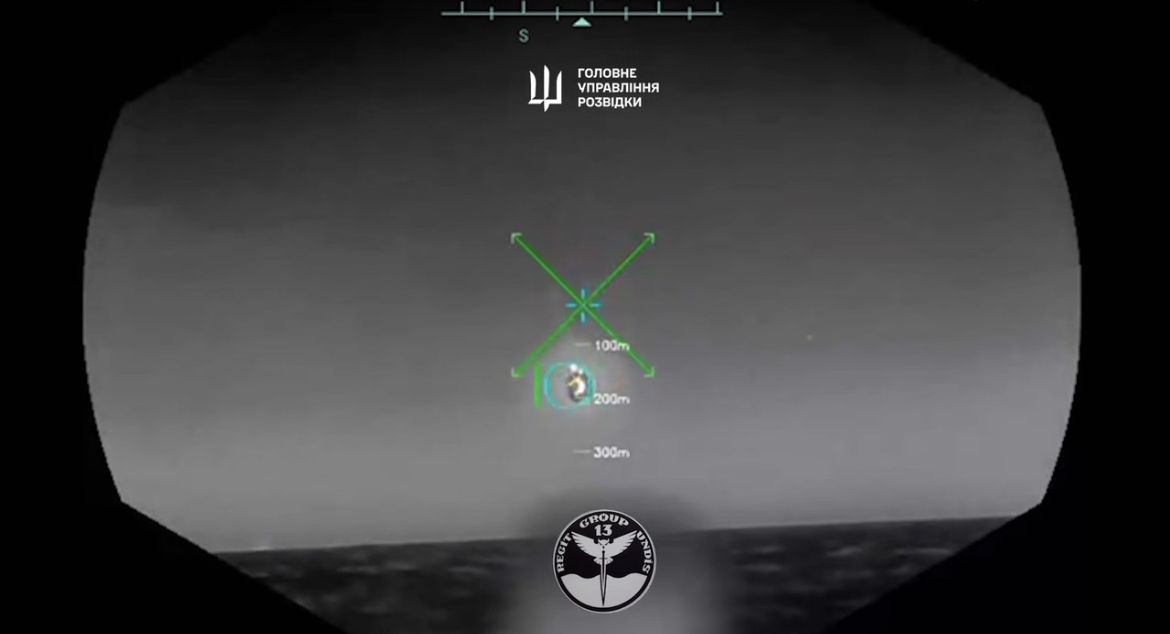

Ukrainian sea drone downs Russian fighter jet in 'world-first' strike, intelligence says

Editors' Picks

How medics of Ukraine’s 3rd Assault Brigade deal with horrors of drone warfare

As Russia trains abducted children for war, Ukraine fights uphill battle to bring them home

'I just hate the Russians' — Kyiv district recovers from drone strike as ceasefire remains elusive